From January 2023, the CINSF Default Fund will change from the Conservative Fund to the Balanced Fund for existing Default Fund members.

Every 3 years the CINSF Board and Trustee review the CINSF’S Statement of Investment Policies and Objectives (SIPO). This process considers, amongst other items, the changes in the investment markets, the objectives of the Fund, and its performance to date.

The primary reason for the change in the Default Fund is to provide members who have not made an investment direction, with an improved longer-term opportunity for higher investment returns.

With an objective of supporting security in retirement through maximizing returns to members during their accumulation phase (i.e. the period in which a member made their first contribution up to the final contribution before retirement date), and then considering the investment directions made by members that drive their own performance, the Board and Trustee can determine if members are, in general terms, meeting their objectives.

The member investment options have been in place since 2015, and although the CINSF office has maintained a strong outreach to employers and members, over 90% of members have still not made an investment direction and remain in the current (Conservative) Default Fund.

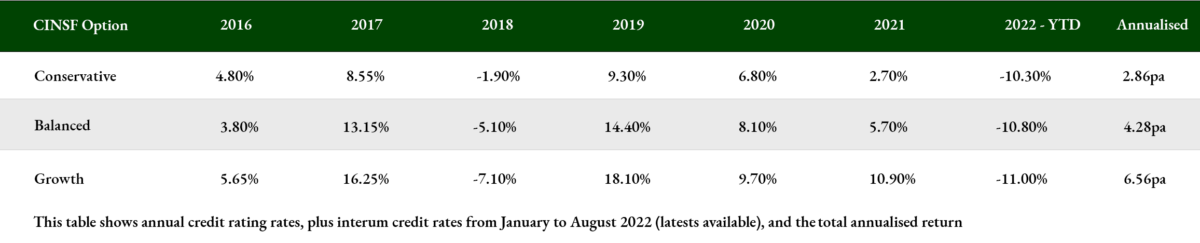

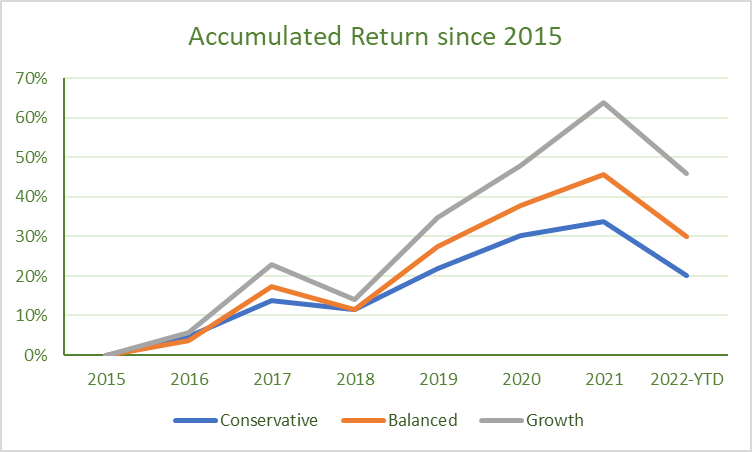

Since the inception of the investment options (Conservative, Balanced, Growth), the difference in investment returns and performance between them, provides a clear distinction on a risk vs reward basis. From the comparison below, we can see that the Balanced and Growth Funds generally provide better returns to members than the current (Conservative) Default Fund.

Passive and active funds

Our new (Balanced) Default fund is made up of 100% passively managed investments.

A passive fund invests in a very similar mix of shares to the market index it is aiming to replicate (such as the S&P 500). This type of investing strategy tends to invest most in larger companies, imitating what the average investor in the market is invested in.

Active management is where a fund manager selects shares or other assets for a portfolio according to the companies or sectors, they think stand the best chance of being strong performers.

Passive managed investments are generally lower in fees compared to active managed investments.

What do I have to do?

If you have never made an investment direction (selected an investment option when you joined the CINSF, or completed an investment switch form), then you are in the current (Conservative) Default Fund.

From January 2023 you will be automatically moved from the old (Conservative) Default Fund to the new (Balanced) Default Fund.

If you do not want to be moved, and you would like to select your own investment direction, then you can come into the CINSF office and complete an investment switch form.