I’ve read that the CINSF Default option will change from Conservative to Balanced as of 1 January 2023. What does this mean?

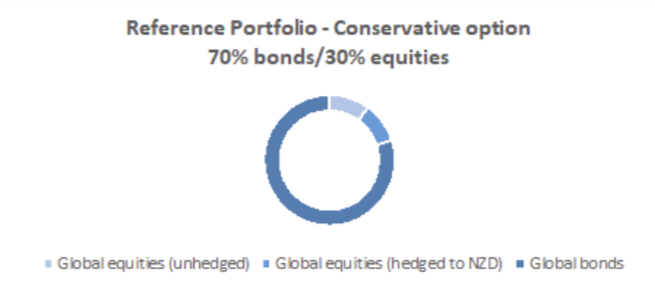

Historically, the Default fund for CINSF has been the Conservative option (70% bonds, 30% equities split) which means that if you did not make an active choice in selecting your investment direction (i.e. you didn’t choose out of Conservative, Balanced, or Growth when you registered with us) then you would automatically “default” to the Conservative option as your investment direction.

The Conservative option provides a safer choice for investment due to its minimized exposure to risk. However, because one of the aims of the CINSF is to provide a stream of income for your retirement i.e. long term horizon for investment, the Conservative option potentially reaps a much lower return on investment than the Balanced or Growth options that has more exposure to shares in the global stock markets.

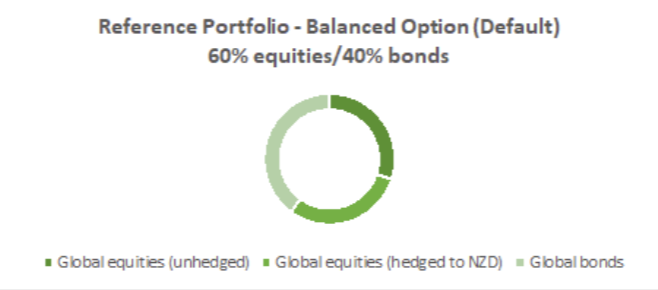

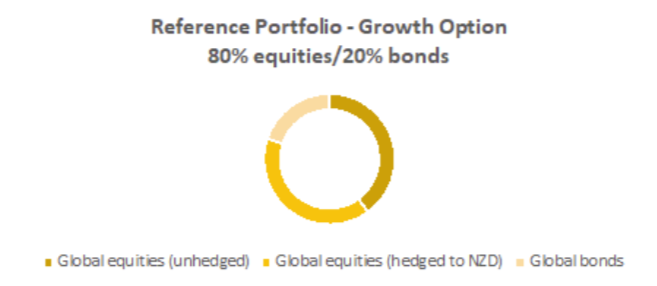

The majority of our Members will invest into our Fund long term. This means the average Member will have a longer period of time battle the market and how unpredictable it can be sometimes (this is what we mean by market risk). Changing the Default to Balanced, although it means a slightly higher level of risk to a 60% equity/40% bonds split, it also means Members will have a greater return on investment in the long run.

When selecting an appropriate Option for you to invest in, it might be wise to seek independent financial advice. A quick questionnaire that may help you in choosing is available here.

But I don’t want to be in the Balanced option at all – I want to stay in the Conservative option. Is that doable?

Yes! Everyone has the right to make an investment direction dependent on their risk appetite. This means that if you feel uncomfortable taking more risk in your investments, you can tell us before 31 December 2022 by filling out an Investment Switch form and we will keep your investment strategic direction kept in the Conservative option if you so wish.

Alternatively, if you would like to split your investment direction (e.g. 50% Balanced, 50% Growth or 20% Conservative, 80% Growth), you can note this down on the Investment Switch form too.

When the new changes come into effect, will the money I previously invested into the Conservative option change to the Balanced option?

Short answer – not just yet. The new change is only for your strategic direction of your investments going forward. Your legacy balance (or money that you have previously invested and accumulated with us) will remain as is until we finish a larger piece of work that will ultimately shift full balances from Conservative to the Balanced option. Once again, as you are the Member, you do have the power to make the choice as it is your money – and if you do not wish for this to happen, you can always tell us.

I’ve also read that CINSF recently changed its investment managers to Smartshares. What does this mean?

A huge change for the Fund and the way we invest – and a much more cost-effective decision for us (and you!).

Previously, we used a style of investing called “Active Investment” which basically means that there is a more rigorous process that our previous investment managers had to undertake in order to seek a favourable return for our Members. In short, active investment costs more.

Over the last year, our team embarked on some research into what it would look like if we implemented a Reference Portfolio approach using passive products such as ETFs (that Smartshares offered). Put simply, a Reference Portfolio acts as a benchmark whereby any returns that are made above the benchmark for each option will be seen as value added. This “value add” difference allows us to diversify our Portfolio and undertake other types of investments such as direct investments in the domestic market or in the wider Pacific region, or even other active investments if that is suitable for the time.

For more information on the products we now invest in, please visit our How We Invest page.